Condo Insurance in and around Jerome

Condo unitowners of Jerome, State Farm has you covered.

Protect your condo the smart way

- Jerome

- Wendell

- Gooding

- Shoshone

- Twin Falls

- Kimberly

- Filer

- Buhl

- Hagerman

- Castleford

- Eden

- Hazelton

- Hansen

- Murtaugh

- Dietrich

- Bellevue

- Hailey

- Carey

- Fairfield

Your Belongings Need Coverage—and So Does Your Condominium.

Committing to condo ownership is an exciting decision. You need to consider home layout your future needs and more. But once you find the perfect condominium to call home, you also need dependable insurance. Finding the right coverage can help your Jerome unit be a sweet place to call home!

Condo unitowners of Jerome, State Farm has you covered.

Protect your condo the smart way

Why Condo Owners In Jerome Choose State Farm

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has plenty options to keep your condo and its contents protected. You’ll get coverage options to match your specific needs. Thank goodness that you won’t have to figure that out by yourself. With personal attention and fantastic customer service, Agent Collin Sharp can walk you through every step to help build a policy that protects your condo unit and everything you’ve invested in.

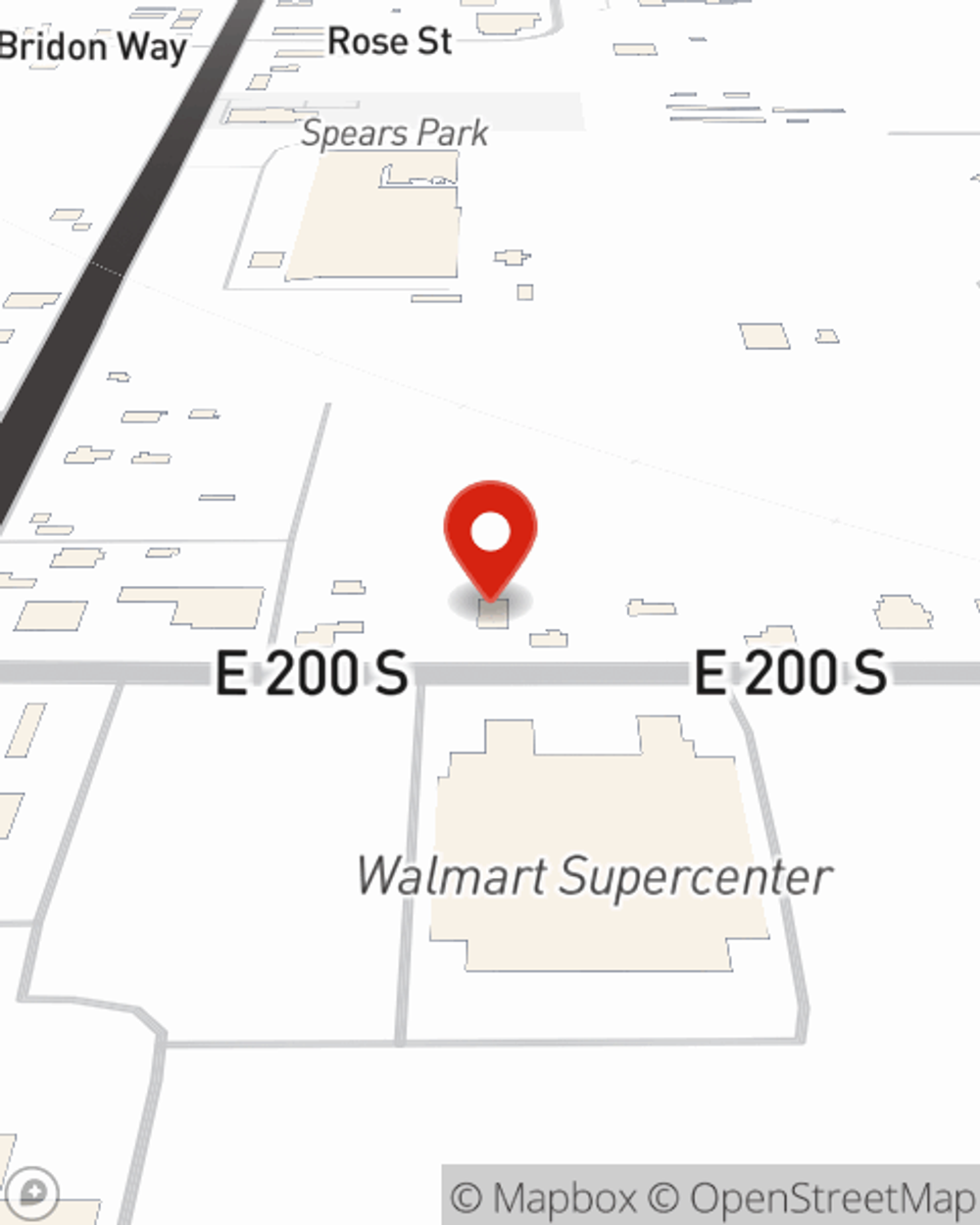

Jerome condo owners, are you ready to see what a State Farm policy can do for you? Get in touch with State Farm Agent Collin Sharp today.

Have More Questions About Condo Unitowners Insurance?

Call Collin at (208) 324-3772 or visit our FAQ page.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Collin Sharp

State Farm® Insurance AgentSimple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.